Overall, prepaid expenses are an important accounting concept that helps businesses to better manage their cash flow and accurately reflect the value of goods and services received over time. From a company’s point of view, an increase in prepaid expenses is a debit. Later, when the prepaid expense is used, a company records an expense for the product or service which is a debit, and the prepaid expense gets canceled out through a credit. While prepaid expenses are initially recorded as an asset, they eventually transition to an expense on the income statement when the product or service is incurred.

Common examples of prepaid expenses are rent, insurance, and specialized products. Using the same example as before, at the end of the first quarter the company makes an adjusting entry for their quarterly reports. The company will debit insurance expenses for $500 and credit prepaid insurance for $500. The $500 is calculated by dividing the $2,000 in prepaid insurance for the year by 4, since the company has now incurred a quarter of insurance coverage. For example, a company prepays $2,000 in insurance premiums for the year.

Journal entry for prepaid rent as an asset

As the benefits of the good or service are realized over time, the asset’s value is decreased, and the amount is expensed to the income statement. Prepaid expenses tangible assets overview of physical items of value for business in accounting begins with the journal entry that creates the prepaid asset. We would debit the prepaid expense account and credit the cash payment.

Prepaid expenses are essentially prepayments that have been made for a product or service whose value will only be realised in the future. Prepaid expenses help you lock in a product or service at the current market price. For example, if you believe fuel prices will go up next month, you may want to prepay for fuel to avoid paying extra when the price rises. If there is any product or service that you cannot afford to miss, then it is better that you pay in advance. For example, the rent you pay for your office building is a prepaid expense. You don’t want to miss getting the space and hence pay the rent amount for a month or quarter in advance.

It’s not expensed immediately because the company has not yet benefited from the services. As future invoices come in, the company would recognize an expense and draw down the prepaid asset by the same amount. The easiest way to manage prepaid expenses is by using accounting software, which will automatically post a journal entry each month to reduce the balance in your prepaid accounts. But even if you simply use a spreadsheet to calculate your monthly expenses, managing prepaid expenses is one of the easier things you’ll need to manage. Your next step would be to record the insurance expense for the next 12 months.

Prepaid Expenses: Everything You Need to Know

The expense is then gradually recognised over the period it is consumed, through an adjusting entry. This means that the expense is spread out over time, rather than being recognised all at once. It can sometimes be bucketed with other current assets like in the example below for PepsiCo’s balance sheet. To learn more about PepsiCo’s financial statements, you can click here. The initial journal entry for a prepaid expense does not affect a company’s financial statements. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

The term “outstanding rent” refers to rent due for a period that has already passed. Data analysis software offers businesses solutions for collecting, storing and analyzing information that’s critical to their success. Our API-first development strategy gives you the keys to integrate your finance tech stack – from one ERP to one hundred – and create seamless data flows in and out of BlackLine. If you recently attended webinar you loved, find it here and share the link with your colleagues.

What is a prepaid expenses journal entry?

To create your first journal entry for prepaid expenses, debit your Prepaid Expense account. This account is an asset account, and assets are increased by debits. Credit the corresponding account you used to make the payment, like a Cash or Checking account. The adjusting entry for prepaid expenses made at the end of an accounting period involves a debit to an expense account and a credit to a prepaid expense account.

‘I worked as a server and every dollar that a customer left you on the credit card they took 25 cents’: Careful with prepaid gift cards at restaurants, expert warns – The Daily Dot

‘I worked as a server and every dollar that a customer left you on the credit card they took 25 cents’: Careful with prepaid gift cards at restaurants, expert warns.

Posted: Sun, 03 Sep 2023 19:58:59 GMT [source]

Learn more about prepaid expenses, how they impact your financial statements, and why they need to be recorded differently from regular expenses. As you use the prepaid item, decrease your Prepaid Expense account and increase your actual Expense account. To do this, debit your Expense account and credit your Prepaid Expense account. Create a prepaid expenses journal entry in your books at the time of purchase, before using the good or service.

Prepaid Expenses Definition

Clearly, no insurance company would sell insurance that covers an unfortunate event after the fact, so insurance expenses must be prepaid by businesses. With amortization, the amount of a common accrual, such as prepaid rent, is gradually reduced to zero, following what is known as an amortization schedule. The expense is then transferred to the profit and loss statement for the period during which the company uses up the accrual. Accounting records that do not include adjusting entries to show the expiration or consumption of prepaid expenses overstate assets and net income and understate expenses. Almost any expense paid in advance can be considered a prepaid expense.

SIMcontrol: Manage all your company SIM cards on one platform – ITWeb

SIMcontrol: Manage all your company SIM cards on one platform.

Posted: Mon, 04 Sep 2023 06:31:27 GMT [source]

Your success is our success.From onboarding to financial operations excellence, our customer success management team helps you unlock measurable value. Through workshops, webinars, digital success options, tips and tricks, and more, you will develop leading-practice processes and strategies to propel your organization forward. Accelerate adoption and drive productivity and performance.One of the critical success drivers for any software technology is effective user training and adoption. Whether you are deploying for the first time or creating a sustainable education program for maximum value creation, explore how you can take the next steps to upskill your users.

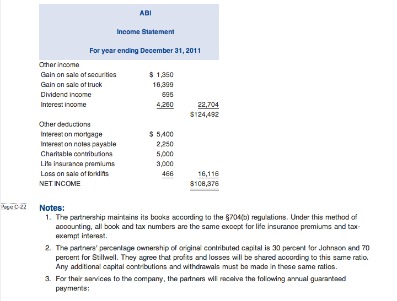

A company would pay ₹12,000 to cover 12 months of insurance, and the current asset it records at payment is ₹12,000 to reflect this prepaid amount. The company would record an expense of ₹1,000 each month and draw the prepaid assets by the same amount. The most-common examples of prepaid expenses in accounting are prepaid rent from leases, prepaid software subscriptions, and prepaid insurance premiums. Below you’ll find a detailed description of each one as well as detailed accounting examples for each. A business will record prepaid rent as an asset on the balance sheet because it represents a future benefit that is due to the business.

What type of account is prepaid rent?

Thankfully though, companies may still drastically lower their risk of encountering minor errors by automating their entire accounting procedure using smart credit control platforms like Kolleno. In summary, Kolleno is an all-in-one software that can be integrated into a business’s existing workflow, with the accounting team being seamlessly onboarded in no time. Thus, the firm need not waste time and human resources to learn a completely novel accounting tool for their day-to-day operations. Prepaid expenses are classified as assets as they represent goods and services that will be consumed, typically within a year. Timely, reliable data is critical for decision-making and reporting throughout the M&A lifecycle.

- We are here for you with industry-leading support whenever and wherever you need it.

- Prepaid rent is not initially recorded on the income statement because according to the GAAP matching principle, expenses cannot be reported on the income statement before they are incurred.

- Understanding how prepaid expenses actually work can help you record and calculate them accurately for the balance sheet and income statement.

- We help them move to modern accounting by unifying their data and processes, automating repetitive work, and driving accountability through visibility.

Drive visibility, accountability, and control across every accounting checklist.

But if you pay your rent for the entire upcoming year, that is a prepaid expense and needs to be recorded as one. Repeat the process each month until the policy is used and the asset account is empty. As a reminder, the main types of accounts are assets, expenses, liabilities, equity, and revenue. Let’s say that Bill’s Retail Store pays its insurance premiums every six months. The policy is renewed after six months, and Bill then pays ₹700 for a seven-month extension. Bill is purchasing seven months of insurance when he makes his premium payment, which means that he pays for the benefits before he uses them.

To extend this concept further, consider charging remaining balances to expense once they have been amortized down to a certain minimum level. Both of these actions should be governed by a formal accounting policy that states the threshold at which prepaid expenses are to be charged to expense. As the benefits of the prepaid expenses are availed over time, they are recorded in the income statement. Prepaid expenses are considered current assets because they are expected to be utilized for standard business operations within a year. BlackLine is a high-growth, SaaS business that is transforming and modernizing the way finance and accounting departments operate. Our cloud software automates critical finance and accounting processes.